Excerpt

In recent years, the fintech industry has become highly competitive, with many strong players appearing on the market. However, does this mean that new companies cannot disrupt this market? Absolutely not, and this startup is a good proof of that. This company easily secured $100 million in investment by identifying a unique niche, which also helped it reduce its marketing efforts significantly. Read on to find out what they do and how they managed to attract investment so easily.

Intro

Fintech today is a highly competitive market with many strong players emerging in recent years. But does this mean that entering the fintech services market is becoming impossible? Not at all. In today’s review, we will discuss how this startup, which attracted $100M in investment, found its unique and profitable niche, significantly reducing their marketing costs.

The essence of the idea

Bank scoring when obtaining a loan or credit card can be problematic if you do not have a stable job or a well-established business. However, the world is changing rapidly, and new professions are emerging that are not easily understood by traditional-minded organizations such as banks.

Among these are bloggers and social media influencers, individuals who earn money from their online content. To many banks, such a client might seem unemployed, and their income from social networks does not fit into the category of stable income.

As a result, these individuals are likely to fail the bank’s scoring system and not receive a loan or credit card. Despite this, social media influencers can be extremely well-paid, and it is imprudent to exclude such individuals from the list of reliable clients.

Karat noticed this situation and entered the market with a unique product – a credit card specifically designed for content creators and bloggers.

The business model

The main slogan of the company is “Banks don’t understand creators. We do.”

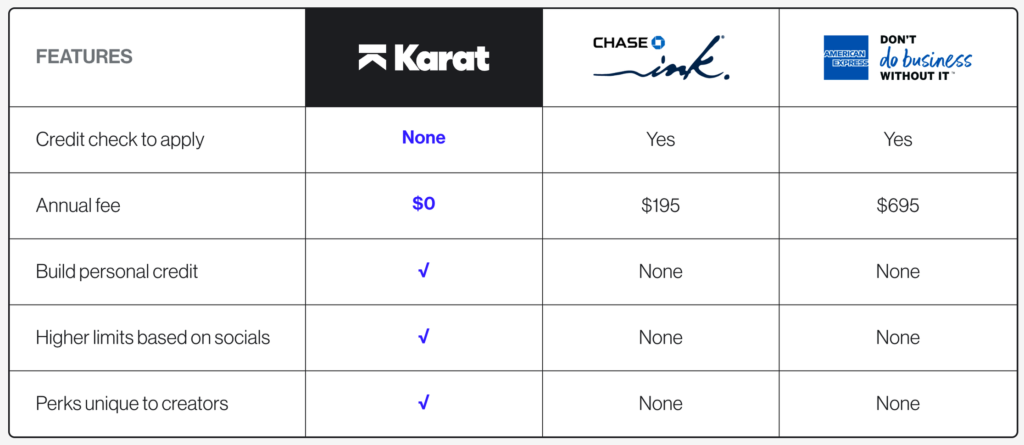

This slogan is very accurate and reveals what Karat does. The company offers a credit card targeted specifically at content creators. In fact, this is not even a traditional credit card, but a payment card with deferred payment. At the end of every calendar month, you need to pay off your balance, the amount spent in the previous month. At the same time, you do not pay interest or fees if you pay off on time. Concurrently, you are building up a reliable credit history that you can use later when applying for larger loans.

Bank scoring is usually a sophisticated algorithm, but in the case of Karat, this problem is very simple to solve. When registering with the service, you enter your social network profiles, Karat estimates the size of your audience and calculates your social media reach. Nothing could be easier!

Karat is a very media-oriented company. Where is the most common place for media content creators to communicate? That’s right, in Instagram DMs. Accordingly, the service support team operates through Instagram DMs.

And here we come to the most interesting part. The key problem of any business, especially a startup, is marketing. Every startup has to spend a lot of resources and creativity to attract an audience. Karat solves this problem gracefully. After all, content creators are public figures who have a large audience. They willingly share all the news from their lives, especially when they like the product. In addition, in any professional community, people closely monitor each other, and the news that some popular blogger has started using a service aimed at bloggers definitely encourages them to try this service as well.

How Karat makes money

The company has three main sources of income. First, there are fees late payments if you didn’t pay your debt in time. Second, is a commission from the brands promoting their goods with Karat and the payments for promoting certain influencers on Karat’s website. And finally, the company offers a set of paid services for tax management, bookkeeping and accounting.

Fintech is a very competitive market and it is very difficult to enter it with some product designed for a mass audience. But there are a large number of niches in which FINTECH Services can be offered. It was such a niche that Karat found. What does this mean for fauners who also want to build their fintech startup? Try to find a relatively narrow, but sufficient niche for money, find which product can be in demand from this audience and why other companies do not provide it. Build a marketing company in the channels that this audience uses at the same time trying to involve your users in the marketing of your product.

The Three-Bullet Recipe

- Simple and understandable financial model.

- A narrow but solvent audience.

- Effective marketing that customers themselves do.

The Founders

- Eric Wei – https://www.linkedin.com/in/eric-wei-43078068/

- Will Kim – https://www.linkedin.com/in/wdkim

The funding

- $4.5M Seed – June 2020 (Kevin Lin, Coatue, and SignalFire)

- $26M Series A – July 2021 (Union Square Ventures and debt)

- $70M Series B – July, 2023 (SignalFire and TriplePoint Capital)