Intro

- As a marketplace owner, your earnings come from sales.

- As a stockbroker, you earn when stocks are bought or sold.

- Therefore, stockbrokers potentially have a more profitable business model than marketplaces.

- However, stock trading is heavily regulated, and securing a broker’s license can be expensive.

- But what if the stockbroker concept could be applied to other markets? This startup identified such a market and did exactly that.

The problem

Investing in company shares is a time-tested method to put money into a business, anticipating the potential increase in stock value. However, to invest in a company, its shares need to be listed on the stock exchange, or you should invest as an early-stage investor.

In recent years, the trend of rising personal brands has become apparent. It’s an intriguing opportunity to invest in someone’s personal brand, much like investing in a company. Until recently, there wasn’t a well-established method for doing so, but now it’s possible with the help of such platform we’re reviewing today.

The solution

GigaStar is a startup with a mission to empower YouTube creators and their fans via a revenue-sharing model. The platform enables content creators to offer a portion of their potential future channel revenue to both individual and institutional investors in the form of tokens.

Through the platform, YouTube Creators can offer a percentage of their channel’s future revenue during a “drop” – a public offering that lasts for a minimum of 21 days.

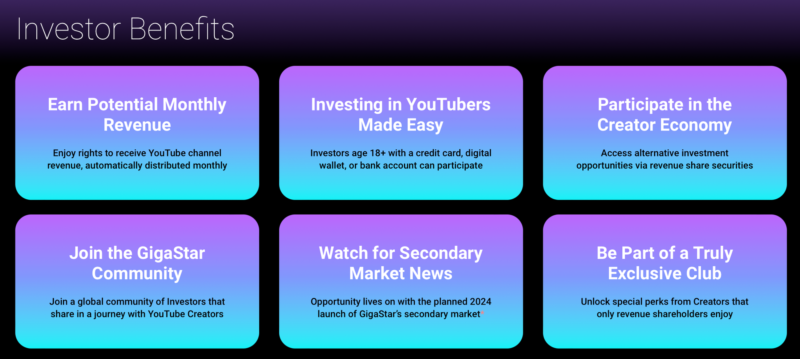

During this period, investors have the opportunity to purchase rights to a share of the revenue. Once the drop successfully concludes, the YouTube Creator receives the raised funds, and investors start receiving monthly revenue payouts.

Once the offering successfully concludes, the funds are transferred to the channel owner. The content creator can utilize these funds as they see fit: upgrading equipment, hiring staff, launching products, making donations, paying debts, running campaigns, and so forth. If the offering isn’t successful, investors receive a full refund.

Interestingly, GigaStar Market’s revenue-sharing offering only includes revenue generated within the YouTube ecosystem, such as AdSense, Super Chats, and paid memberships. Any additional revenue streams a content creator might have, like sponsorship or brand deal revenue, remain untouched and the channel owner keeps 100% of it.

After the expected launch of GigaStar’s secondary market in 2024, investors will have the option to sell their tokens to other investors. Alternatively, they can sell them back to YouTube channel owners, provided the owners decide to buy back.

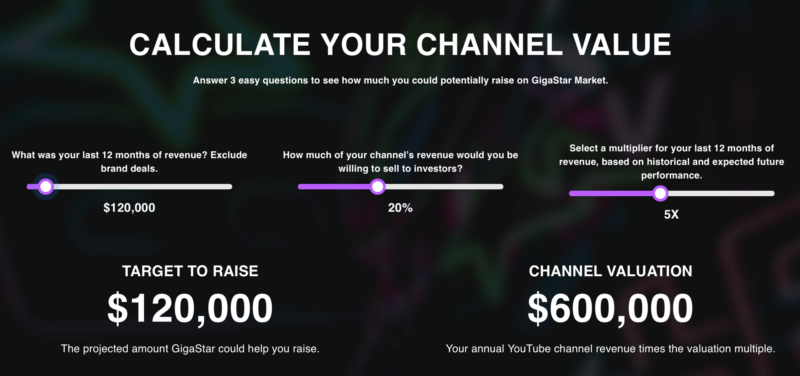

There is a calculator available for a quick assessment of your channel value. For this, you need to document your channel revenue for the past 12 months and provide a revenue multiplier to forecast future performance. Additionally, specify the percentage of your future revenue you are going to sell.

That’s the trickiest part because it’s unclear how correct it is to use this previous 12-month multiplier as a basis for future revenue projection.

Purchasing the revenue share gives investors Channel Revenue Tokens (CRTs). These tokens are issued and regulated under the Crowdfunding Regulation act by the US Securities and Exchange Commission (SEC).

One key rule is that these tokens are subject to a 12-month restricted period after closing, during which they cannot be traded.

A portion of the YouTube channel’s potential future revenue is automatically distributed to investors each month. As the channel grows, both creators and investors stand to benefit.

Investors also gain access to private Discord clubs as an extra perk. This is not just about the monetary aspect, but it also serves as an important bonus for many subscribers due to their emotional connection with their favourite bloggers.

How GigaStart attracts investors?

A unique feature of GigaStar is that it doesn’t actively seek investors. Each large YouTube channel has many subscribers, a portion of whom are typically devoted fans.

The channel owner simply needs to post a message encouraging their subscribers to invest in their favorite channel, thereby attracting them to the platform. Essentially, the bulk of the marketing and user acquisition is done by the YouTube channels themselves. Isn’t that a fantastic concept?

The business model

The company’s business model focuses on democratizing the creator economy, enabling followers to actively contribute to the success of their favorite content creators.

The minimum investment required for GigaStar’s revenue-sharing securities is not specified. Channel owners can set the minimum contribution and establish various funding levels. Most creators set their levels between $50-$200, but other amounts can be set if desired.

Channel owners set their goals for max offering amount. The process of accepting investment commitments stopped once this level is reached.

According to GigaStar, it currently boasts 12,030 investor accounts, with $1,181,812 raised for creators and $62,342 distributed to investors, what is really not bad because it is approximately 6%.

For instance, the channel with the highest offered amount is “ClearValue Tax”. This financial services-focused channel boasts 1.95M subscribers. They managed to raise $720K, exceeding their funding goal of $120K by six times.

The offered revenue share is 20%, indicating that the channel owner is offering you a 20% share of all future revenue from the channel. Unlike traditional startup funding, you will not own a share in the future market cap, but you will earn a percentage of future revenue.

However, as mentioned earlier, in 2024, investors will have the opportunity to trade revenue shares in GigaStar’s secondary market. In this scenario, shares could be sold to other investors, and creators will also have the option to buy back their CRTs if they desire.

This is a crucial detail that aligns the interests of investors and content creators since in the stock market, investors are less interested in receiving dividends and more focused on the growth of the share value.

At the same time, it should be mentioned that only 7 channels are cited as raising money. This figure is critically low to make any decisions about this platform’s business potential.

What is the difference with other crowdfunding platforms

There are many well operating crowdfunding platforms. They utilise different concepts, for example:

Kickstarter model (Rewards Crowdfunding)

Rewards-based crowdfunding is a prevalent option. It involves establishing different levels of rewards corresponding to various pledge amounts.

StartEngine (Equity Crowdfunding)

In equity crowdfunding, investors buy a stake in the entity, such as shares in a startup or membership interests in a company (or partnership) that owns real estate. Equity interests can be either primary or secondary to other ownership interests, and they are always secondary to the rights of the entity’s creditors.

Patreon (Donation Crowdfunding)

Donation crowdfunding is precisely as it sounds – these campaigns collect donations without the obligation to offer anything of value in return. This type of campaign is most suitable for social causes and charities.

Kiva (Lending Crowdfunding)

Lending-based crowdfunding enables entrepreneurs to raise funds as loans. They then repay these loans to lenders over a pre-determined timeline, with a specified interest rate.

GigaStar (Revenue Sharing Crowdfunding)

GigaStar operates under a revenue-sharing model, where it offers investors a percentage of a project or product’s revenue. This implies that investors receive a share of the project’s profits. However, they do not acquire any ownership stake or voting rights in the company.

The technology behind

The company utilizes blockchain technology to provide creators with simplified access to funding and innovative fan engagement.

Channel Revenue Tokens (CRTs) are digital representations of securities offered under Regulation Crowdfunding (Reg CF).

GigaStar has a unique mechanism that accesses the revenue delivered by YouTube to the channel owner’s account and automatically distributes a portion of it to the investor accounts.

To store your CRTs, you need a Polygon-supported wallet, such as Metamask or TrustWallet.

The market

In 2022, YouTube generated nearly $29.24 billion in global advertising revenue, marking a modest increase of less than 2% from the previous fiscal period. As YouTube’s user base is expected to exceed 1.1 billion people by 2028, advertising revenue is projected to continue growing in the coming years.

YouTube pays a specific amount for every 1000 views. However, the exact amount varies depending on the content niche. For instance, a gaming YouTuber might receive $4 for every 1000 views, while a real estate YouTuber could earn as much as $15 per 1000 views.

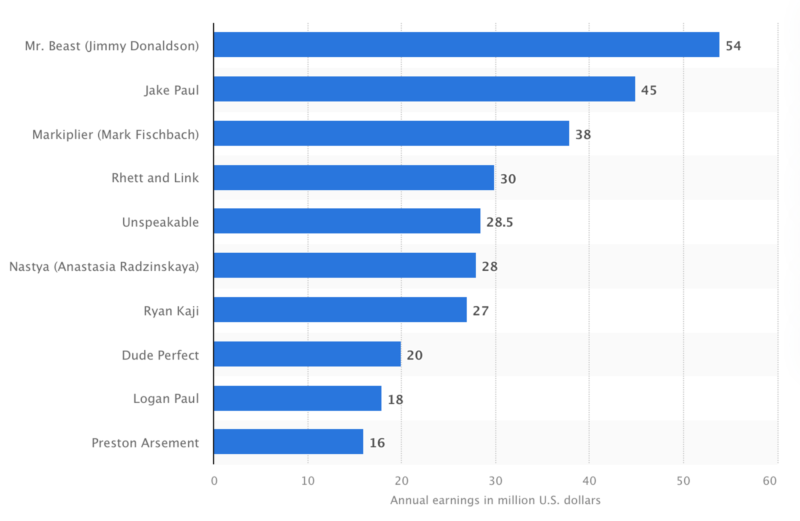

For example, in 2021, MrBeast’s YouTube channel generated the highest revenue at $54 million, followed by Jake Paul and Markiplier.

In conclusion, GigaStar has successfully identified a profitable and valuable niche.

The company

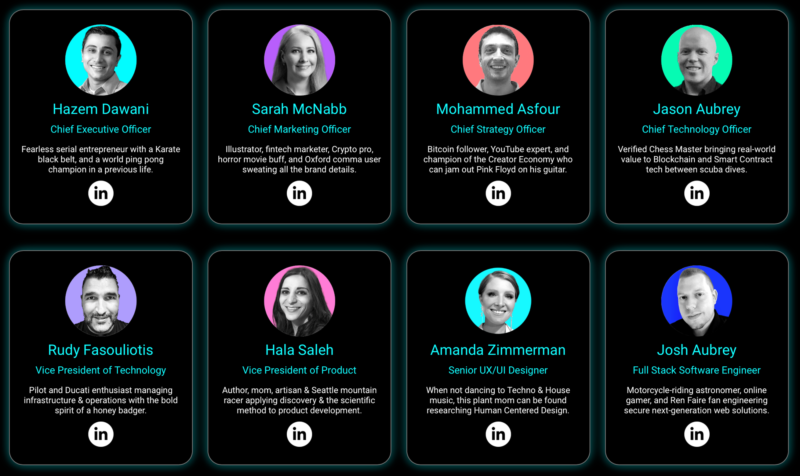

GigaStar was founded in 2022 and is headquartered in Chicago, Illinois, USA by Hazem Dawani, Jason Aubrey, and Mohammed Asfour. Currently the company now has 23 employees.

The funding

The company completed its third seed funding round on Dec 28, 2023, raising $4.8M. Investors included Tomsic Holdings, Nameless Ventures, and Belvedere Strategic Capital.

The company has now conducted three seed rounds – on May 19, 2022, Mar 16, 2023, and Dec 28, 2023 – with a total investment of $11M.

What is interesting

This isn’t the first startup we’ve reviewed that targets content creators. For instance, we recently reviewed Karat, a credit card specifically designed for bloggers and content creators.

Another example is HomeCooks, a food delivery marketplace that brings together independent chefs.

All of these platforms share a common feature: they partner with socially and media-active figures. This partnership forms the cornerstone of their business models. Marketing expenditures aimed at attracting end users can be a burden for any business, especially startups.

However, by targeting media content creators as your audience, you can significantly reduce your marketing budget. More importantly, this approach can accelerate your growth tenfold.

Conclusion

Collaborating with social media influencers can be highly beneficial. They offer a solid audience base and inherent leverage for marketing, which can contribute to the successful growth of your business. We strongly recommend considering this opportunity. If you need more insights on similar business models recently launched, feel free to contact us at random@randomround.com.